Overview of VyStar Credit Union

VyStar Credit Union, commonly known as VyStar, is a credit union headquartered in Jacksonville, Florida. VyStar Credit Union is a member-owned, member-managed financial cooperative with a volunteer Board of Directors.

VyStar is chartered and regulated by the State of Florida and is a federally insured credit union.

VyStar is a full-service credit union that is highly known for its well-crafted service delivery from nearly 1600 employees, more than full-service branch locations with extended business hours, nine high school branches, about 200 ATMs, two drive-through centers, and Internet and mobile banking applications.

VyStar’s vision is “to be the primary financial institution for our members and to bring credit union services to more people.”

VyStar Credit Union has grown to become one of the largest credit unions in the nation, serving over 500,000 members nationwide.

History of VyStar Credit Union

VyStar Credit Union, known formerly as Jax Navy Federal was founded in the year 1952, in order to serve civil service members, military employees and their families at the Naval Air Station Jacksonville (NAS Jax), Florida.

During that time, obtaining financial services, particularly loans, was a herculean task and was difficult for working men and women, who would often fall prey to unfair and deceptive lending practices.

For that very reason, VyStar Credit Union was founded in order to provide military families with access to the financial services they needed.

It began with a meagre 12 members and just $60 as capital. After the first year of operation, it had just 1,100 members and just over $28,000 in assets. Now it has grown to be one of the largest credit unions in America.

Working of VyStar Credit Union

VyStar’s nine-person volunteer Board of Directors provides strategic direction and oversees the management of the credit union for its members.

VyStar’s volunteer Audit Committee adds balance to the credit union’s activities as it actively oversees special activities and internal audits.

Additionally, there are more than 1,000 employees who keep VyStar running smoothly for its members each and every day.

Regulation of Deposit at VyStar Credit Union

The deposits, a member has in VyStar Credit Union, are insured by the National Credit Union Share Insurance Fund (NCUSIF), an arm of the National Credit Union Administration (NCUA).

Members of VyStar can ask them for a copy of “Your Insured Funds” for complete information on the type of insurance coverage the concerned members’ have.

NCUSIF was established by the Congress in 1970 to insure member share accounts at federally insured credit unions.

The NCUSIF is managed by NCUA under the direction of the three-person NCUA Board. The members of the NCUA Board are nominated by the President of the United States of America and confirmed by the Senate.

A members’ insurance is similar to the deposit insurance protection offered by the Federal Deposit Insurance Corporation (FDIC).

It is remarkable to state that, not one penny of insured savings has ever been lost by a member of a federally insured credit union.

Facts about VyStar Credit Union

VyStar Credit Union is the largest mortgage lender in Northeast Florida. It is the 4th largest financial institution in Northeast Florida with assets of $9 billion and serving over 675,000 members.

VyStar is the 15th largest credit union in the US, i.e., VyStar ranks 15 out of credit unions totaling over 5,500 present in the US. Also, VyStar is the 14th largest employer in Northeast Florida, employing over 1,500 people.

Checking services of VyStar Credit Union

VyStar Credit Union’s members receive interest on the money kept in their accounts with VyStar.

The rate of the interest received is dependent upon the rates that VyStar charges for loans and the income it receives from investments, as well as its ability to cost-effectively manage the operations of the credit union.

Vystar’s interest rates are reviewed weekly by a team of senior management employees and volunteer board members designated by the Rate Committee.

Rates are posted in the branches and available on its website also.

- Checking

Benefits of checking available to customers are as follows:

- Earning Interest on All Deposits

- Free Unlimited Check Writing

- No Monthly Service Charges

- No-Fee Debit Card

- Overdraft Protection

- Fewer Fees

- No Minimum Balance Requirements

VyStar Credit Union members also don’t pay fees for any of the following:

- Checking balance online or by phone

- Transferring money between accounts

- Using a VyStar debit card at any VyStar ATM

- Money Market Account With Checks

VyStar’s money market account includes:

- No Minimum Balance Requirement

- Competitive Interest

- Tiered Yield Structure

- Optional Overdraft Protection

- Checks for Easy Access to Funds

Savings Services of VyStar Credit Union

VyStar Credit Union offers savings opportunities with its savings accounts.They are as follows:

• Competitive Dividends which leads to earn money while one saves money. Funds deposited in the VyStar savings account also accrue interest over time at competitive rates.

• Overdraft Protection as VyStar savings account can be used for overdraft protection for one’s checking account. This safeguards the concerned from insufficient funds fees and check returns.

• No Service Charges

•Access to Funds by Mail, Branches, Phone, ATM, and Personal Computer

Investment Services of VyStar Credit Union

One can explore investment options and make investment decisions with the helpful advice of a VyStar Investment Services LPL Financial Advisor.

LPL Financial is one of the leading financial services companies and a publicly traded company under ticker symbol LPLA.

The firm’s mission is rooted in the belief that objective financial guidance is a fundamental need for everyone. LPL does not offer proprietary investment products or engage in investment banking activities.

This implies that advisors affiliated with LPL are not pressured or influenced by LPL to sell its products.

VyStar Credit Union makes investment and financial management products available to help a person pursue his or her short- and long-term financial goals, investment timelines, and risk tolerance levels.

They provide financial analysis and planning services at no cost or obligation.

VyStar Credit Union helps its members by:

• Building an Investment Strategy

• Planning a More Comfortable Retirement

• Pursuing Assets & Financial Future

• Funding Children’s Education

One can have access to a comprehensive list of value-oriented products and services, including:

• Fixed and Variable

• Asset Allocation Annuities

• Insurance

• Mutual Funds

• IRAs

• Securities Trading

Protection services offered by VyStar Credit Union

There are many checks and balances present in the function of VyStar Credit Union, which makes it a reliable organization. Some of them are as follows:

- Payment Protection

We offer easy ways to help protect your family’s financial future. One of these is the option to insure your VyStar consumer loans with credit life and/or credit disability coverage up to $50,000 per loan amount.

- Extend Vehicle Protection

VyStar Credit Union offers extended warranty coverage through IWS. The cost is less than that offered at most dealerships, and there is a 60-day money back guarantee.

One can visit any of Vystar’s branch offices or phone its Call Center for more information on all its loan programmes.

- Guaranteed Asset Protection (GAP) Plus

GAP can cancel or reduce a person’s loan balance in the event that the insured vehicle is stolen and not recovered, or damaged beyond repair, and the primary insurance does not cover the balance owed on the loan.

- FraudScoutTM Fraud & Credit Monitoring Services

Credit is one of the most important assets a person possesses, and identity theft is one of the fastest-growing crimes in the U.S.

FraudScoutTM fraud and credit monitoring services can provide the extra protection a person needs to help avoid a potentially damaging situation.

The service searches millions of identity records and non-credit sources to identify potential fraud in credit, non-credit and public records.

When suspicious activity is detected, an email alert will be sent within moments. These alerts may come days or even months before the theft would normally be detected.

- Home Equity Programs

VyStar Credit Union offers fixed-rate home equity loan programs based on the percentage of the home’s value borrowed(loan-to-value ratio).

VyStar Credit Union’s variable-rate home equity lines of credit with checks gives immediate access to cash and are available for people who can more easily utilize a revolving line of credit for changing financial needs.

One can choose interest-only payment option to reduce loan payments each month. As well as no need to pay closing costs on a home equity line of credit when an initial draw of $10,000 or more is made.

Certain terms and conditions may apply.

Services offered by Vystar Credit Union

Some of the ways in which VyStar Credit Union can help a business or nonprofit association grow and prosper are:

- Business Loans: This is an excellent source of funds for general purposes, such as vehicle purchases. VyStar Credit Union offers equipment financing at competitive rates.

- Real Estate Loans: VyStar Credit Union finances small, mid-sized and larger commercial properties.

One can qualify for no closing costs up to 2% of the loan amount and a variety of financing options for owner-occupied and investment properties (does not include residential investment property).

Flexible terms, local underwriting, competitive rates are some of its appealing aspects.

- Business Savings Account: Earn dividends with easy access to your funds. With a low opening deposit, you’ll get easy-to-read monthly statements that make record keeping and money management a snap.

A business savings account is a membership requirement.

- Small Business Checking Account: Perfect for businesses with limited account activity and for businesses just starting out.

Have flexibility plus the opportunity to earn competitive yields with only a $2,500 account balance. Up to 100 items* can be processed per month at no charge.

- Regular Business Checking Account: It is ideal for businesses for an average small business.

A no opening deposit offers no fees for up to 250 items* per month at no monthly service charge when a minimum daily balance of $5,000 is maintained.

For debit cards, checks or temporary checks, there is a $100 minimum deposit requirement.

Convenience Services offered by VyStar Credit Union

VyStar Credit Union offers a number of convenience services to its customers in order to make their lives easier, such as:

ATM Service

A VyStar ATM card can be used at any VyStar ATM or at any of the 20,000+ surcharge-free ATMs nationwide in the US. They also provide a Spanish-language option. The major benefits of this service are as follows:

- Activating new VyStar debit card, business debit card or Home Equity Platinum Visa®.

- Getting cash from the account.

- Transferring funds between accounts and check balances.

- Making deposits, VyStar loan payments, and obtaining balance information.

- Changing ATM card, debit card, business debit card or Home Equity Platinum Visa Car PIN.

Magic Touch

Access your accounts by phone with this voice-response telephone service. Perform the following transactions: checking Balance Inquiries and Transaction histories; making Loan payments; Checking reorders; Transferring funds; performing Credit Card Payments, etc.

VyStar Online

This facility gives access to information about VyStar Credit Union and VyStar Financial Group, LLC, along with many of the tools needed to perform daily financial transactions. The main uses are as follows:

- Internet Banking: Beneficial in case of Transferring funds, checking balances, opening a new account, ordering checks, paying bills, applying for a loan, reviewing e-Statements, viewing checks and more.

- Deposit Services: Helps to Order a debit card, check VyStar’s deposit rates, learn about IRAs, and find out more about other products and services.

- Loan Services: Helps to Visit the Lending & Loan Protection area to check loan rates, research and price a new or used car, find ways to apply for a loan and refinance your existing car from another creditor, and more.

- Locations: Finding the addresses and phone numbers of Vystar’s offices and ATMs throughout the VyStar area.

- Legal: Helps in Reviewing VyStar’s Disclosures on how accounts work, along with their Privacy and Security Statements to protect its members.

- Financial Calculators: They help in determining a loan payment, converting currency, or even finding the current stock market information.

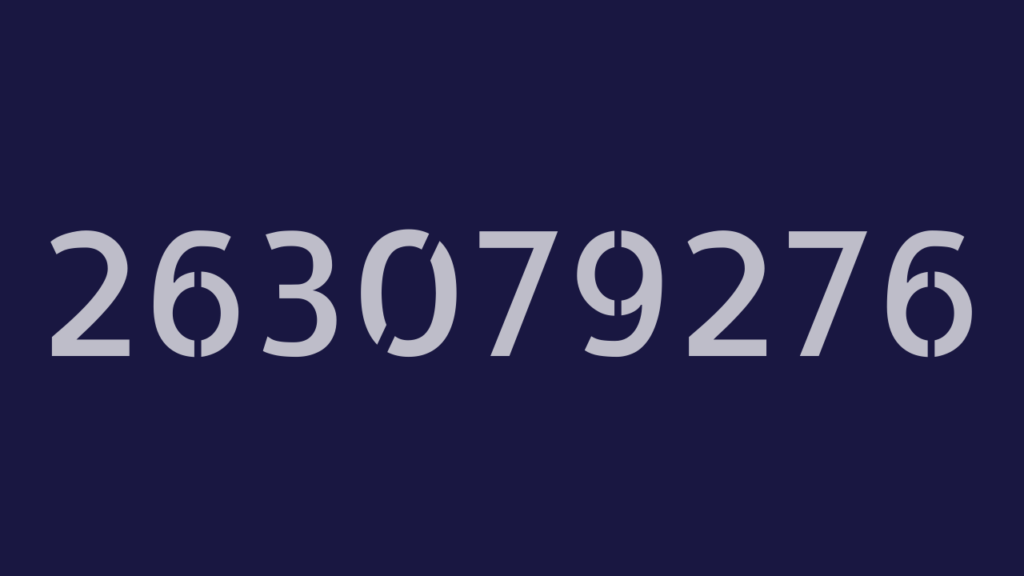

VyStar Credit Union Routing Number

VyStar Credit Union’s routing number for the purpose of direct deposits and wire transfers is 263079276.

Hours of Operation at VyStar Credit Union

VyStar Credit Union’s branch hours of operation are:

From Monday through Thursday,

9:00 a.m. to 5:00 p.m.

On Friday,

9:00 a.m. to 6:00 p.m.

And on Saturday,

9:00 a.m. to 3:00 p.m.

VyStar’s Call Center hours of operation are 7 days a week from 7:00 a.m. to 7:00 p.m., excluding holidays. Anyone can reach Vystar’s Call Center at (904) 777-6000 or 1 (800) 445-6289.

Values of the VyStar Credit Union

Since its inception in 1952, VyStar Credit Union has been dedicated to improving the financial lives of its members and supporting the communities in Florida and Southeast Georgia counties, where its members live and work.

This dedication is clearly reflected in its vision to be the primary financial institution for our members and to bring credit union services to more people.

VyStar Credit Union remains true to its founding fathers’ vision of providing a safe place for their members to borrow and save, and to give them access to quality financial products and services that would help in improving their financial well-being.

As VyStar Credit Union has grown, so has its support for local causes that are important to the communities it serves.

VyStar has made it a goal to do more in support of the communities that have supported them since their establishment in 1952.

VyStar Credit Union, FL offers its membership to all individuals living or working in, as well as any business, club, church, organization or association located in from Northeast to Central Florida and Southeast Georgia.

VyStar Credit Union has continued the tradition of “people helping people,” which can be witnessed by its excellent position in the vicinity of Florida and nearby areas.