Headquartered in Moline, Illinois, Vibrant Credit Union is a member-owned, not-for-profit financial cooperative. Vibrant Credit Union (formerly known as DHCU Community CU) has been open since 1935.

Vibrant is the 13th largest credit union in Illinois with assets totalling $800 Million. Vibrant Credit Union provides banking services to more than 49,000 members.

Vibrant offers everything from savings and checking accounts to low rate mortgage and home equity programs.

There are some business services available including, checking, business credit cards, merchant card services and much more.

Vibrant has seven Member Service locations in Bettendorf, Clinton, Davenport, East Moline, Eldrige, Geneseo, Milan, and Moline.

Vibrant has been recognized as one of the top 5 Credit Unions to Work for in the United States and the top place for Young Professionals to work.

Using a heavy relationship approach, Vibrant Credit Union has been recognized as a true partner to its communities and membership in proving, there is a better way to bank.

Vibrant Credit Union is part of the All-Point ATM Networks and CO-OP Shared Branching.

History of the Vibrant Credit Union

Vibrant Credit Union was started in 1935 to serve the workers of John Deere and is headquartered in Moline, Illinois.

The DHCU Community Credit Union changed its name to Vibrant Credit Union to “better reflect its approach to financial services” on May 11, 2015.

Membership of the Vibrant Credit Union

Vibrant Credit Union serves the entire Quad City community. Membership is open to anyone who lives or works within 50 miles of any Vibrant Credit Union’s branch.

Located along the beautiful Mississippi River bordered by Iowa and Illinois, the Quad Cities is home to one of the oldest member-owned financial institutions in the area.

The Quad Cities is a region of five cities in the U.S. states of Iowa and Illinois which encompasses Davenport and Bettendorf in southeastern Iowa, and Rock Island, Moline, and East Moline in northwestern Illinois.

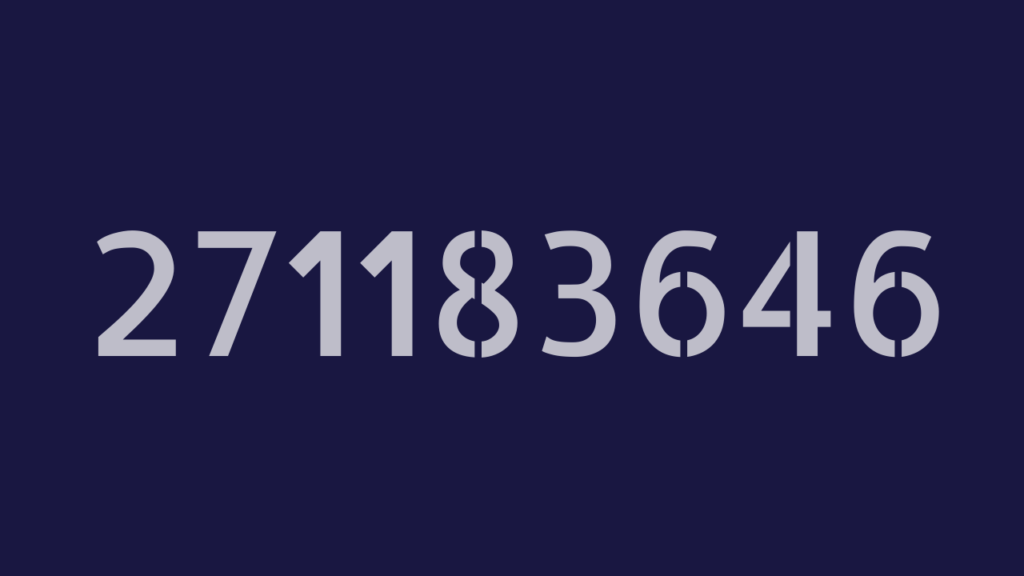

Vibrant Credit Union Routing Number

The routing number of the Vibrant Credit Union is 271183646. It can be used for the purpose of direct deposits.

Vibrant Credit Union Locations And Working Hours

The hours of operation at the Vibrant Credit Union are as follows:

1. Outside of Vibrant branch

3230 Ridge Pointe

Bettendorf, IA 52722

Monday: 8:30 am – 5:00 pm

Tuesday: 8:30 am – 5:00 pm

Wednesday: 8:30 am – 5:00 pm

Thursday: 8:30 am – 5:00 pm

Friday: 8:30 am – 5:00 pm

Saturday: 8:30 am – 12:00 pm

Sunday: Closed

Drive Through Hours:

Monday: 8:30 am – 5:00 pm

Tuesday: 8:30 am – 5:00 pm

Wednesday: 8:30 am – 5:00 pm

Thursday: 8:30 am – 5:00 pm

Friday: 8:30 am – 6:00 pm

Saturday: 8:30 am to 12:00 pm

Sunday: Closed

Different Facets of the Vibrant Credit Union

There are different facets of the Vibrant Credit Union, which are as follows:

- Save the Community Day

Vibrant Credit Union believes so strongly in making its communities vibrant, that it provides 8 hours of “volunteer time off” annually to employees.

This could happen in a single day or be broken up into smaller commitments over time. The only rule is that the time must be volunteered to a 501(c)(3) organization.

- The Vibrant Cares Campaign

Vibrant has long held an interest in giving back to the local communities in which it serves. The philanthropic spirit is simply a part of its DNA.

Vibrant Credit Union takes great pride and pleasure in helping improve the lives of people in the communities. The Vibrant Cares Campaign provides the organization’s employees an opportunity to select from up to three local and three national charities to provide contributions. Employees have the option to make regular bi-weekly paycheck deductions or to provide a one time annual donation.

- Motivational Moments

Employees start their days at the Vibrant Credit Union with line dancing. Happy employees make for happy members, so each of Vibrant Credit Union’s locations kicks off the day with a Motivational Moment. These 15-minute company meetings can be anything from musical chairs to a paper airplane contest. The only rule to be followed is that everybody must participate and nobody is allowed to talk shop. No business talk is involved.

- Everyday is Jeans Day

Vibrant advocates that there is no need to be in a three piece suit to provide sound financial service and advice to members. Hence, Vibrant Credit Union’s staff have the option to dress professionally or in business casual attire 6 days a week, Monday through Saturday and are encouraged to “dress for their day”.

- T-Shirts and Tennis Shoes

At the Vibrant, Fridays are celebrated with “Casual for a Cause” program. Team members may be elected to contribute $5 per month for the opportunity to couple a Vibrant T-Shirt and Tennis Shoes. These contributions are then distributed to the monthly charity or benevolent initiative of the month.

- 24 Hour Gym

Vibrant Credit Union provides its employees with the best opportunity to be happy and healthy. Vibrant provides a 24-hour gym at its corporate center. It is noted that, healthy employees tend to be happier and more productive employees. Vibrant Credit Union provides gym memberships to staff members at branch locations in other communities, to ensure that they have the opportunity to invest in their health as well.

- Monthly Theme Days

There is a provision of a monthly theme day at the Vibrant. The monthly theme days ensure that Vibrant Credit Union lives to its mission of providing a surprisingly different banking experience. The branch and Corporate team of the Vibrant that demonstrates the most outstanding theme is frequently treated to a catered lunch.

- Culture Club

Culture Club is a critical component of Vibrant Credit Union’s culture. Hence, it wants to create an environment that fosters strong team dynamics. The Vibrant Culture Club works to see that staff members have a monthly opportunity to connect socially with their teammates outside of their work environment. These events include complimentary tickets for team members and their family members to baseball games, zoos, drive in movie theaters, local pumpkin patches, and much more.

- Strengths Based Culture

Vibrant has a workplace environment that focuses on each employee’s strengths. Every new employee has to complete Gallup’s Strengths Finder Assessment and their results are shared openly with the organization. Managers then receive training to ensure that they understand their team’s individual talents at a deep level to ensure that, they have an opportunity to apply their strengths to their work on a regular basis.

- Education Reimbursement

Vibrant provides financial support to eligible employees who participate in various externally sponsored educational courses, which meet certain criteria. Such support is intended to hone employees’ professional development and their skills and knowledge related to their business.

- Giving One’s Mojo A Break

Vibrant does recognizes the fact that employees need time for rest, relaxation, and other personal and family needs. Vibrant Credit Union’s comprehensive time-off plan permits employees to take time to enjoy activities and interests outside of work that support their well-being. The benefits include: paid time off (PTO), paid holidays, bereavement leave, jury duty leave, etc.

Medical Insurance offered by the Vibrant Credit Union

Vibrant offers medical insurance coverage through Blue Cross Blue Shield of Illinois. This scheme is available with multiple plan options that offers comprehensive coverage and provider network choices as well as out-of-pocket maximums, in order to provide financial protection from expensive medical bills due to an illness or injury. Vibrant Credit Union’s employees share in the cost of coverage through pre-tax contributions and coverage is available for the employee, spouse, and/or dependent children.

Plan options include:

● High-deductible PPO with Health Savings Account (HSA)

● Traditional PPO

Dental Insurance offered by the Vibrant Credit Union

Vibrant offers dental insurance coverage through Principal. Coverage includes preventive and diagnostic care, basic and major restorative care, orthodontia (child), and a maximum accumulation carryover feature. Employees share in the cost of coverage through pre-tax contributions. Employees may elect dental coverage independently of medical insurance, with coverage available to the employee, spouse, and/or dependent children.

Vision Insurance offered by Vibrant Credit Union

Vibrant offers vision insurance coverage through Principal, who utilizes the Vision Service Provider (VSP) network. Employees may elect vision coverage independently of medical insurance. This plan is designed to encourage the best care at the lowest out-of-pocket cost and provides benefits toward the cost of an annual eye exam, lenses, and frames or contacts. Employees share in the cost of coverage through pre-tax contributions, and coverage is available for the employee, spouse, and/or dependent children.

Employee Assistance Program

The Employee Assistance Program (EAP) is a free and confidential counseling service to help resolve personal issues in a subtle manner. Under this program, experienced, licensed mental health professionals (including psychologists, clinical social workers and marriage, family and child counselors) are available to help with:

● Marital, family or relationship problems

● Stress, anxiety or depression

● Adolescent behavior problems

● Alcoholism or drug dependency

● Conflicts at work or at home (occupational issues, balancing work and life, etc.)

● Eating disorders

● Stress from financial or legal difficulties

The EAP has well-trained specialists on staff 24-hours a day, seven days a week. Assistance sought is held in the strictest of confidence; the employee’s right to privacy is one of the most crucial aspects of this program. The cost incurred during initial assessments and short-term counseling is covered by the Vibrant Credit Union. If there is requirement for continued treatment or additional services, it is to be borne by the employee or family member, but it may be later covered by the health insurance plans.

Flexible Spending Account (FSA) Plan of the Vibrant Credit Union

Vibrant Credit Union offers two additional voluntary opportunities for employees to pay for select out of pocket expenses with pre-tax dollars, including both Medical Expenses and Dependent Care.

- FSA – Medical

Under the Medical Reimbursement Program, employees can set aside a portion of their regular income from each paycheck (up to $2,700) before payroll taxes are taken out to pay for eligible health care expenses for themself and eligible dependents, such as: medical, dental or vision deductibles, copays and coinsurance.

● Prescribed drugs

● Eyeglasses, contact lenses and contact lens supplies

● Orthodontia

● Prescribed over-the-counter drugs

● Medical supplies such as crutches, ice pack, hearing aids, insulin supplies, etc.

● Laser eye surgery

● And much more!

- FSA – Dependent Care

This excellent benefit allows employees to pay for eligible dependent care expenses (up to $5,000) with pre-tax dollars, including nursery, daycare, or home care expenses for dependent children under the age of 13, full coverage of expenses for a dependent disabled child regardless of age. In addition to that, benefits through this plan are also available to employees who provide at least 51% of the support for a disabled spouse or parent.

Miscellaneous Plans of the Vibrant Credit Union

Various plans of the Vibrant Credit Union, which are beneficial for members’ are as follows:

401(K) Retirement Plan

Vibrant Credit Union’s 401(k) plan is the most ideal way to save for retirement. Eligible employees are allowed to make pre-tax and/or post-tax contributions of your eligible pay by electing the percentage of pay per pay period, up to the IRS maximum limit each year.

Vibrant Credit Union matches a person’s contributions dollar for dollar up to 6% of eligible pay. Employees are fully granted the interest in Credit Union contributions after being employed for five (5) or more years.

Basic Life/AD&D Insurance

Vibrant Credit Union provides eligible employees and their eligible dependents Group Life Insurance coverage at No Cost. This coverage also includes an Accidental Death & Dismemberment (AD&D) rider. The benefit value is:

● Employee: 2x annual salary up to $350,000 max

● Spouse: Flat $10,000

● Child(ren): Flat $5,000

Beneficiaries are appointed by the employee and can be changed at any time.

Voluntary Life Insurance

Employees can add supplemental life insurance coverage for themselves and/or their eligible dependents; creating the combination that is right for them and their family. Employees pay the entire cost of any supplemental coverage in post-tax dollars. Cost is based on age and election amount.

● Employee: $10,000 increments up to $500,000

● Spouse: 50% of employee amount up to a max of $150,000

● Child(ren): $1,000 – $10,000 in increments of $1,000