Headquartered in Missoula, Montana, Missoula Federal Credit Union (MFCU) is a locally owned, not-for-profit financial cooperative.

MFCU is Montana’s second-largest credit union and largest Community Development Financial Institution.

Missoula Federal Credit Union’s membership now draws from 20 counties in western and central Montana. As of 2019, Missoula Federal Credit Union has more than 50,000 members and manages more than $500 million in assets.

All the deposits at Missoula Federal Credit Union are insured by the National Credit Union Administration (NCUA).

Missoula Federal Credit Union was founded in 1956, and later, it merged with the University of Montana Credit Union and Northern Pacific Credit Union to become Missoula’s leading financial institution.

MFCU has partnered successfully with CO-OP to offer almost 30,000 surcharge-free ATM’s and over 5,000 shared branches to its members.

The credit union has prided itself on providing excellent service and a wide variety of products and services to members throughout its history.

Missoula Federal Credit Union has adopted a “values-based banking” approach.

This approach is exclusively centered on cooperative ownership, always being inclusive, empowering its staff personnel as well as members, and delivering positive social, economic, and environmental impacts in all spheres of life.

History of Missoula Federal Credit Union

A police officer in Missoula named Herb Roehl had a problem. It was the year 1956, and Herb had just started his new job with the Missoula Police Department.

He was thrilled to finally be a police officer, but his salary barely covered the basics for his young family, and it didn’t leave him much room to get ahead.

Herb wasn’t alone, though; some of his fellow police colleagues were having the same problem.

So Herb and seven of his colleagues pooled their savings together and made loans to one another at cheaper rates than they could have obtained at the local banks.

They incorporated as Missoula Federal Credit Union (MFCU), and each of the original eight members contributed $40 individually.

That amount of $320 was the first cooperative capital on the credit union’s balance sheet.

They kept their records on handwritten cards, and the treasurer kept the money in a shoe box under his bed.

The founding members of the Missoula Federal Credit Union hadn’t gotten any training to run an organization of the sophistication of a credit union. All they did was go by the seat of their pants.

Membership of the Missoula Federal Credit Union

Membership in MFCU is open to individuals, businesses, and organizations in Beaverhead, Broadwater, Cascade, Deer Lodge, Flathead, Gallatin, Granite, Jefferson, Lake, Lewis and Clark, Lincoln, Madison, Meagher, Mineral, Missoula, Park, Powell, Ravalli, Sanders, and Silver Bow counties of Montana.

As well, the membership also includes people in associations headquartered in those counties and people who actively participate in programs to alleviate poverty or distress, whichever are located in those counties.

And membership is also extended to those organizations, whether incorporated or unincorporated, located in or maintaining a facility in the service area.

Routing number of the Missoula Federal Credit Union

The routing number of the Missoula Federal Credit Union is 292977899. The routing number is quite essential for the purpose of the direct deposit.

Working Hours of the Missoula Federal Credit Union

The hours of operation at the Missoula Federal Credit Union are as follows:

- Lobby Hours

From Monday to Thursday,

9:00 am to 4:30 pm

( Stevensville and University branches are open until 5:00 pm )

On Friday,

9:00 am to 5:00 pm

On Saturday,

9:00 am to 1:00 pm

( Reserve Street only )

- Drive-up Hours

From Monday to Friday,

7:30 am to 6:00 pm

( Stevensville branch is open from 9:00 am to 5:00 p.m., and the University Branch remains fully closed.)

On Saturday,

9:00 am to 1:00 pm

( Reserve Street and Russell Branches only )

Branches of the Missoula Federal Credit Union

There are six full-service branch locations of the Missoula Federal Credit Union:

- Downtown Branch

- Reserve Street Branch

- Russell Branch

- Southside Branch

- Stevensville Branch

- University Branch

The new name of the Missoula Federal Credit Union

Missoula Federal Credit Union changed its name to Clearwater Credit Union on September 3, 2019 as a part of its continuing expansion into communities outside Missoula.

According to the Missoula Federal Credit Union board members’, they always loved the name Missoula Federal Credit Union, but it hindered a sense of belongingness for non-Missoulians and limited their ability to demonstrate their values in new communities.

It felt that Missoula Federal Credit Union members and potential members outside Missoula felt that the name was often a hindrance.

It is believed that the name change could help solidify a connection to shared values.

The rationale given by the Missoula Federal Credit Union behind the name change is that the new name is universally appealing and a celebration of Montana’s lakes, rivers, and streams, especially Clearwater River and Clearwater Lake.

The name change gave them the opportunity to speak about “transparency.”

Missoula Federal Credit Union also removed “federal” from its name as part of the change.

They explained that while they remained federally chartered and insured, removing ‘Federal’ from their name made it shorter and more pleasing to say.

In doing so, they reduced the tendency to shorten their name to an acronym.

By removing “federal” from their name, they got the flexibility to become a state-chartered, rather than federally chartered, credit union in the future if they collectively decided about that.

The name change reflected a larger and pre-planned move by Missoula Federal to grow its membership by expanding beyond Missoula County, as pronounced by the five-year strategic plan adopted by the credit union’s Board of Directors in March 2017.

The new logo of the Missoula Federal Credit Union

Missoula Federal Credit Union also adopted a new logo that more widely symbolizes Montana and uses the state flag colors.

The new logo conveyed transparency with the ability to see the mountains through the water drop.

The mountains themselves reflected the beauty of Montana and even formed an ‘M’ in honor of our roots here in Missoula.

The blue, brown, green, and yellow colours reflect Montana’s resources, which are portrayed on the “Oro y Plata” flag depiction.

The new colors are said to be inspired by the Montana state flag, reminding its members of both the incredible natural environment that surrounds them as well as the people and industry that have shaped this amazing place.

Timeline of the Missoula Federal Credit Union

Here are some of the events of great significance for MFCU, in chronological order:

1956: Founded by 8 Missoula Police Officers.

1969: First branch and headquarters on West Pine Street.

1975: Total assets exceeded $1 million.

1976: National Credit Union Administration gave the “Thrift Honor Award” to MFCU, recognizing that it ranks in the top ten percent among national credit unions in deposit growth.

1976: Headquarters moved to South Higgins Street.

1981: Merger with the University of Montana Credit Union.

1982: Headquarters moved to Brooks Street.

1984: Merger with Missoula Northern Pacific Federal Credit Union.

1985: Total assets exceeded $10 million.

1992: The field of membership expanded to include all of Missoula and parts of Ravalli and Lake counties.

1997: Total assets exceeded $100 million.

2002: The field of membership expanded to include all of Missoula, Lake, and Ravalli counties.

2006: The first branch opened outside Missoula, in Stevensville.

2008: The Russell Street branch opens the first LEED-certified building in Missoula. Total assets exceeded $250 million.

2014: MFCU became Montana’s largest Treasury Department-certified Community Development Financial Institution (CDFI).

2017: MFCU became the second credit union in the United States invited to join the Global Alliance for Banking on Values (GABV).

2018: The field of membership expanded to include Missoula, Lake, Ravalli, Beaverhead, Deer Lodge, Granite, and Silver Bow Counties. Total assets exceeded $500 million.

2019: To better serve all members, MFCU changed its name.

Various Activities of the Missoula Federal Credit Union

MFCU has a multifaceted approach to dealing with situations. It has, quite notably, demonstrated it’s mettle by following the following:

- Volunteering

MFCU employees’ volunteered for about 3,494 hours in 2018.

- Financial Counseling

MFCU provided 665 counseling sessions in 2018.

- Philanthropy

MFCU donated the sum of $301,458 to about 150 organizations in the year 2018.

- Awards

MFCU bagged many awards in the preceding year. They are as follows:

- The Western Montana FundRaisers Association bestowed the award of “2018 Outstanding Corporation” on MFCU.

- MFCU was awarded “2018 Employer of the Year” by Missoulian Top Employers in Western Montana.

- Missoulian Missoula’s Choice Awards were also bestowed on MFCU.

- It bagged 1st place in the category of “2018 Best Financial Institution.”.

- And it got 3rd place in the category of “2018 Best Green Business.”.

Loans Granted by the Missoula Federal Credit Union

MFCU granted various types of loans for different needs, which are as follows:

- Consumer Banking

MFCU granted 23,743 consumer loans worth $123,319,170 in 2018.

- Mortgage Banking

MFCU granted 558 mortgage loans worth $56,516,654 in 2018.

- Business Banking

About 489 business loans worth $31,576,143 were granted by MFCU.

- Mortgage Servicing

MFCU serviced 2,006 loans worth $266,893,539 in 2018.

Impactful Services provided by the Missoula Federal Credit Union

Time and again, MFCU’s various activities have shown their intense dedication towards achieving their social values. Some of them are as follows:

- Affordable Housing

One of the most important things MFCU does for its members is help them secure safe and affordable housing.

As home prices continue to rise across much of Montana, manufactured housing is an important source of affordable home ownership.

These homes generally do not qualify for traditional mortgages, and financing for them is excessively expensive, if it is even available at all, due to lending regulations.

In 2017, Missoula Federal Credit Union launched a loan specifically designed to provide affordable financing for manufactured homes.

- Gifts for Veterans

Veteran students attending the University of Montana (UM) could benefit from MFCU’s gift.

MFCU donated $10,000 to UM’s Veterans Scholarship Fund, which helps ensure student success by reducing financial barriers and improving veteran access to higher education at UM.

This gift from MFCU is part of Campaign Montana. Campaign Montana is a comprehensive, seven-year fundraising campaign that is inspiring more than $400 million in philanthropic giving to UM through 2020.

It is hoped that the donors will help achieve UM’s vision of a university that puts student success at the forefront, driving excellence and innovation in teaching, research, and learning.

The management of the campaign is done by the UM Foundation.

- Protector of Environment

Missoula Federal Credit Union participated in the PCAF North America methodology launch. It became one of the 56 institutions to participate in the launch.

Partnership for Carbon Accounting Financials (PCAF) is a global, industry-led partnership to facilitate transparency and accountability in the financial sector to take adequate, meaningful action against climate change.

A carbon accounting approach has been developed by PCAF for financial institutions like Missoula Federal Credit Union to assess and disclose the greenhouse gas (GHG) emissions associated with their loans and investments.

His harmonized accounting approach provides financial institutions with the starting point required to set science-based targets and align their portfolios with the Paris Climate Agreement.

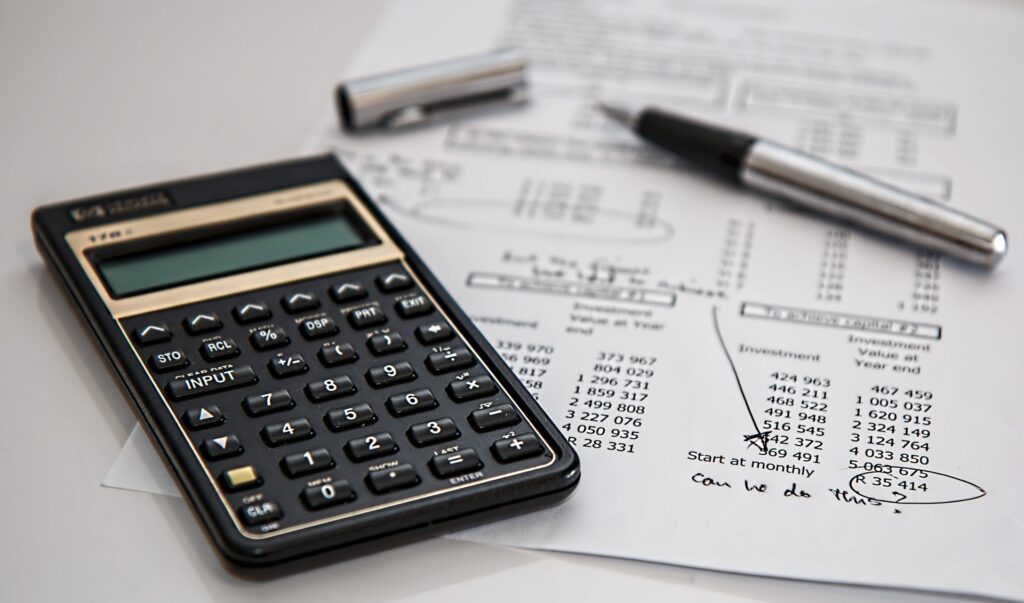

Financial Situation of the Missoula Federal Credit Union

Missoula Federal Credit Union fared quite comfortably through the rough waters. It is quite evident from the facts given below:

- Consistent Growth

Missoula Federal Credit Union finished the year almost 6% above year-end 2017. Balance sheet growth was driven by increasing internal member savings, not external borrowing.

Total member deposits grew by approximately $26 million in 2018. Loan balance growth increased by almost 22% in 2018. MFCU’s total assets increased to $524 million.

- Asset Quality

MFCU’s loan loss rate (actual losses) plus its delinquency rate (loans that are paying late) has declined from 1.87% in 2016, to 1.37% in 2017, to 1.03% in 2018.

- Net Earnings of MFCU

MFCU’s net earnings were $6.8 million in 2018, giving a total return on assets (ROA) of 133 basis points, which is exceptionally high relative to the 83 to 84 basis points of the prior three years.

This high return was driven in part by several expected, one-off events, including upward revaluations of MFCU’s mortgage servicing rights and the resolution of a large impaired loan.

During that same period of time, Missoula Federal Credit Union maintained its operating expense to total asset ratio in the narrow range of 3.41% to 3.46%, and MFCU’s total assets grew from $430 million to $524 million.

The contact number of the Missoula Federal Credit Union

One can get in touch with the Missoula Federal Credit Union by calling their representatives at (406) 523-3300.

The URL of the main website of Missoula Federal Credit Union is https://clearwatercreditunion.org/.